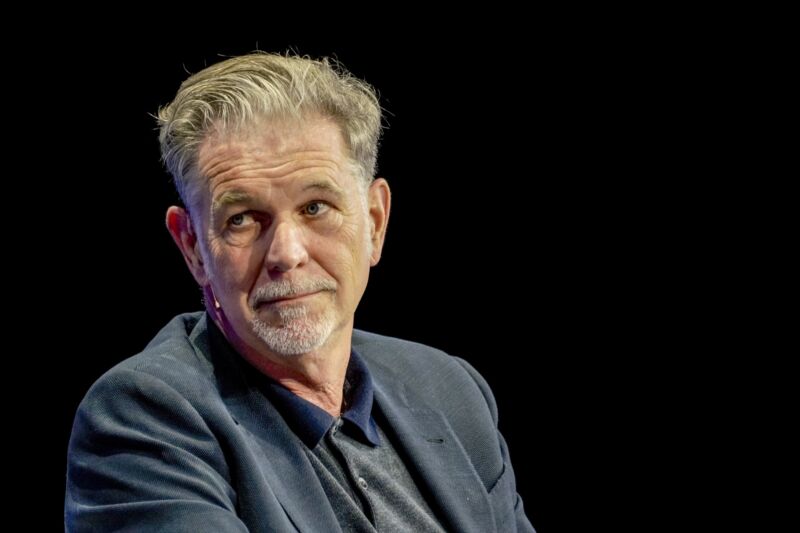

Netflix plans to launch a lower-priced subscription tier with ads, CEO Reed Hastings said Tuesday in an interview to discuss first-quarter earnings. Netflix revenue growth is slowing amid a loss in subscribers, and the company’s stock price was down about 37 percent Wednesday as of this writing.

Hastings said that an ad-supported tier is something “we’re trying to figure out over the next year or two” and that Netflix is “quite open to offering even lower prices with advertising as a consumer choice.”

“Those who follow Netflix know I’ve been against the complexity of advertising and a big fan of the simplicity of subscription,” Hastings said. “But as much as I’m a fan of that, I’m a bigger fan of consumer choice, and allowing consumers who would like to have a lower price and are advertising-tolerant get what they want makes a lot of sense.”

When asked if Netflix will test an ad-supported plan in small markets before a global rollout, Hastings suggested he doesn’t think that will be necessary. “No, I think it’s pretty clear that it’s working for Hulu. Disney’s doing it; HBO did it. I don’t think we have a lot of doubt that it works. You know that all those companies have figured it out. I’m sure we’ll just get in and figure it out as opposed to test it and maybe do it or not do it.”

When Netflix adopts ads, “it would be a plan layer like it is at Hulu so if you still want the ad-free option, you’ll be able to have that as a consumer. And if you’d rather pay a lower price and you’re ad-tolerant, we’re going to cater to you also,” Hastings said. Netflix prices in the US currently range from $9.99 to $19.99 a month.

Update at 4:30pm ET: Netflix stock was down 35.12 percent when the market closed today.

Netflix also fights password-sharing

Netflix last month said it will fight password-sharing by charging an extra fee of about $3 to users who share accounts with people in other households, with the fee rolling out first in Chile, Costa Rica, and Peru.

“[I]n addition to our 222 million paying households, we estimate that Netflix is being shared with over 100 million additional households, including over 30 million in the UCAN region [US and Canada],” Netflix said in its letter to shareholders Tuesday. The letter said that Netflix is planning “more effective monetization of multi-household sharing.”

Netflix said that “account sharing as a percentage of our paying membership hasn’t changed much over the years,” but it’s becoming a bigger focus for the company as it struggles to grow its subscriber base. Hastings discussed plans to tackle account sharing without offering much detail:

We’re working on how to monetize sharing. We’ve been thinking about that for a couple of years, but when we were growing fast, it wasn’t a high priority to work on, and now we’re working super hard on it. Remember, these are over 100 million households that already are choosing to view Netflix. They love the service; we’ve just got to get paid at some degree for them.

Ads not a short-term fix

Hastings also said that ad-supported streaming is “not a short-term fix” for revenue and that it would take a couple of years for ad-supported subscriptions to reach a “material volume” in terms of earnings.

Netflix would rely on third-party advertising services, Hastings said.

“In terms of the profit potential, definitely the online ad market has advanced, and now you don’t have to incorporate all the information about people that you used to, so we can be a straight publisher and have other people do all of the fancy ad matching and integrate all the data about people,” he said. That means Netflix “can stay out of that and really be focused on our members, creating that great experience and then getting monetized in a first-class way by a range of different companies who offer that service.”

Revenue slows, users decline

Netflix’s Q1 revenue was $7.87 billion, up 9.8 percent year over year. Netflix had grown revenue by 16 to 24 percent each quarter during 2021. Netflix projects year-over-year revenue growth of 9.7 percent in Q2 2022.

Net income in Q1 2022 was $1.6 billion, down from $1.71 billion in Q1 2021.

Netflix’s total subscribers dropped from 221.84 million to 221.64 million in the first quarter, and the company forecasted another drop to 219.64 million in the second quarter. Netflix said it would have grown subscribers in the first quarter if not for its decision to pull out of Russia, which reduced subscribers by 700,000.

Despite the Russia pullout, “investors had expected that the company would add new users in the quarter,” The Wall Street Journal wrote. Netflix “stock is down more than 60 percent this year,” including Wednesay’s fall and a previous drop of over 20 percent in January, the Journal wrote.

Hastings: Netflix will “figure this one out”

Netflix attributed some of its struggles to new competition. “[C]ompetition for viewing with linear TV as well as YouTube, Amazon, and Hulu has been robust for the last 15 years,” the shareholder letter said. “However, over the last three years, as traditional entertainment companies realized streaming is the future, many new streaming services have also launched.”

Netflix also said that “macro factors, including sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID are likely having an impact as well.”

Hastings said he’s confident that Netflix will overcome its current struggles. “When we look at the last 20 years, we’ve gone through a lot of changes and we’ve always figured them out one by one. It’s super exciting. We’re going to figure this one out. We’ve got a great team. We lead by a significant margin in streaming, and streaming is continuing to grow around the world,” he said.