What is Redemption of Debentures?

Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem the debentures before the expiry of the fixed period either by instalments or by purchasing them in the open market if authorised by its articles of Association and the terms of issue.

Redemption of Debentures in Lump Sum after stipulated period:

Debentures are loan taken by a company, and being a liability it has to be paid. In this method, the company redeem whole of its debentures in one lump sum at the expiry of a specified period which is the maturity date of the debentures or earlier, at the company’s option. As per the terms of the issue, redemption can be made at par or premium. Before the commencement of redemption of debentures, it is essential to transfer 25% of the face value of debentures issued from Surplus in Statement of Profit & Loss to a newly opened account, “Debenture Redemption Reserve”.This transfer reduces the balance of profits, which ultimately reduces the amount available for dividends. And as this amount is not used for the payment of dividends, it is used to pay for debentures. Such type of redemption is known as Redemption out of profits.

Journal Entries:

i. On creation of Debenture Redemption Reserve:

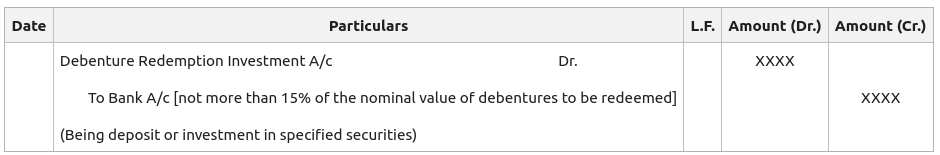

ii. On deposit or investment in Specified Securities:

iii. On making the amount due to Debenture holders:

a. When Debentures are redeemed at Par:

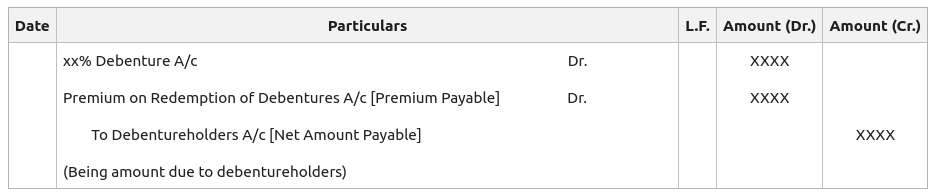

b. When Debentures are redeemed at Premium:

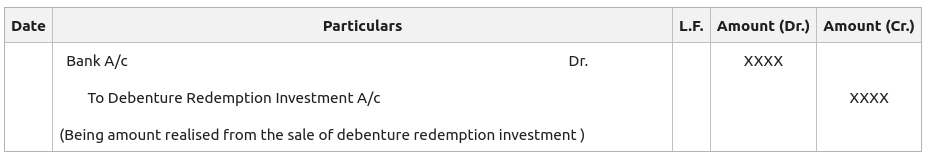

iv. On Sale of Debenture Redemption Investment:

v. On making payment to Debentureholders:

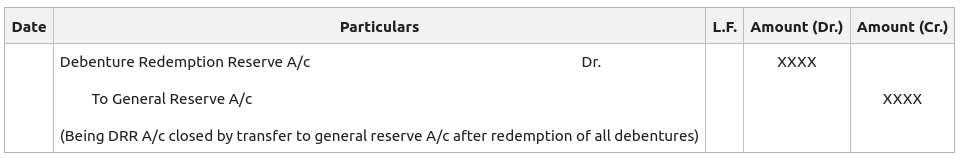

vi. On the closure of DRR after Redemption:

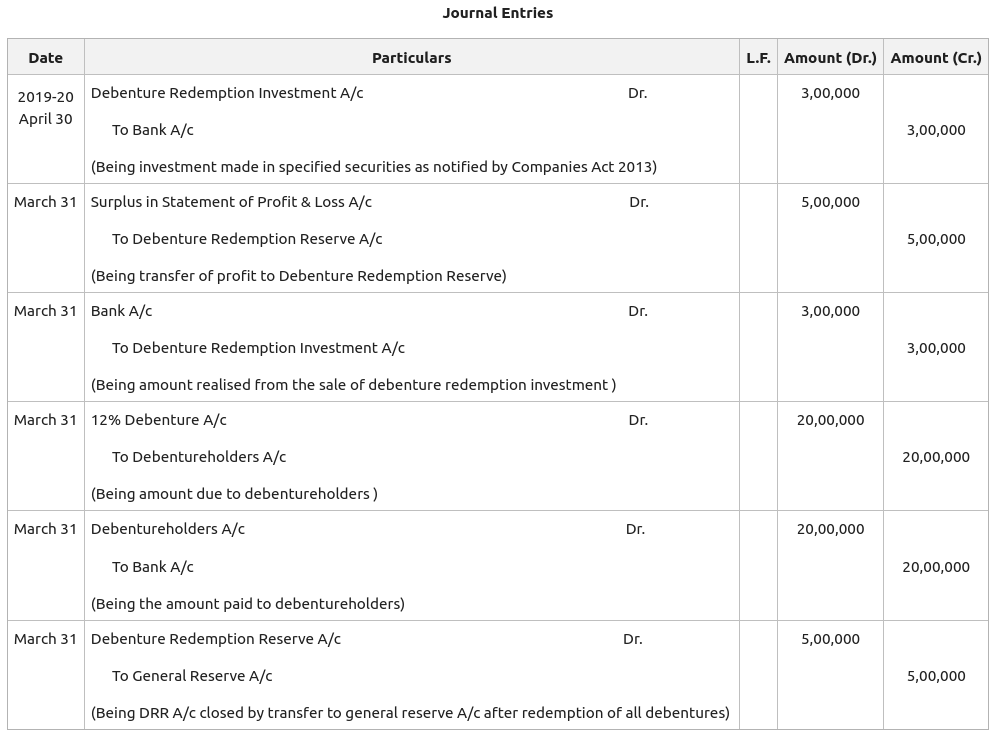

Illustration 1 (Out of Capital):

Sahil Ltd. had outstanding ₹20,00,000, 12% Debentures of ₹100 each due for redemption on 31st March 2020. The required investment was made on 30th April 2019. Pass the necessary journal entries regarding the redemption of debentures, creation of DRR, and Investment.

Solution:

Illustration 2 (Out of Profits):

Sukant Ltd. has a balance of ₹21,00,000 in the Profit & Loss A/c. The company decided to forego the payment of dividend and instead utilise the profits to repay ₹15,00,000,12% Debentures (issued on 1st April 2017) fully out of profits on 30th September 2020 at a premium of 10% Debentures. Interest is payable annually on 31st March every year when the accounts are closed. The company also has a balance of ₹10,00,000 in the Debenture Redemption Reserve. Pass the necessary journal entries both at the time of Issue and Redemption of Debentures.

Solution: