Capital is the amount contributed by the partners in the firm. Partner’s capital shows equity in a partnership owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner’s Capital Account shows the ownership interest in the firm by each partner of the firm. Partner’s Capital Account can either be fixed or fluctuating. It records all the transactions related to the partnership firm and the partners. All the initials transaction and share profit or loss made by the firm, and also the gains or revenue and loss incurred by the firm are recorded in the share of each partner in their capital account.

Methods of Maintaining Capital Account

1. Fixed Capital Method: Fixed Capital means that the capital of the partners is affixed and stationery. The capital of the partners does not change with every transaction and remains the same. It changes only when there is additional capital introduced or drawings are made(withdrawal of capital) by the partner. Two separate accounts are maintained- Partner’s Capital Account and Partner’s Current Account. Partner’s Capital Account is credited with capital contributed and additional capital introduced and debited with withdrawal made by the partner. Partner’s Current Account is debited or credited by the transaction with the firm other than the one directly relating to Capital Account.

2. Fluctuating Capital Method: Fluctuating Capital means that the capitals of the partners fluctuate and are irregular. The capital of the partners changes with every transaction and does not remain the same. Only one capital account is maintained under fluctuating capital method. All the transactions of the partners are recorded under one head separately in the name of each partner, i.e., Partner’s Capital Account. The account is debited or credited by the transactions with the firm relating to the partner.

Meaning of Fluctuating Capital Method:

Under the Fluctuating method of maintaining partners’ capital accounts, the capital balance of each of the partners fluctuates continuously and is not fixed. The reason behind such continuous fluctuation is that no separate account (Current Account) is prepared to record the income and expenses and profits/ losses of the partners. Every item of concern, such as Interest on Capital, Interest on Drawings, Salary, Commission, Share of profit, etc., is recorded in the capital account itself. In case of no instruction is provided, the Fluctuating method should be used to prepare the Partner’s Capital Account.

Steps of Fluctuating Capital Method:

Under this method, only Capital Account is prepared following the given steps:

Step 1: A Capital Account is prepared, and the initial capital invested by the partner is credited to the Capital Account. Further, any additional investments made by the partners are also credited, and any drawings from the capital are recorded on the debit side of the capital account.

Step 2: All the Receipts related to partners, such as Interest on capital, the salary of the partner, the profit share of the partner, commission, etc., are recorded on the credit side of the Capital Account.

Step 3: The debit side of a Capital Account records all the expenses or liabilities related to the partner, such as Interest on drawings.

Step 4: The profit is distributed according to the new profit-sharing ratio among the partners. The profit is credited, and the loss is debited, respectively.

Step 5: Then, the closing capital of the partner is calculated by subtracting the debit side of the Capital Account from the credit side. The closing balance is then transferred to a Balance sheet as a Partner’s Capital Account.

Format (When the Capital is Fluctuating):

Illustration:

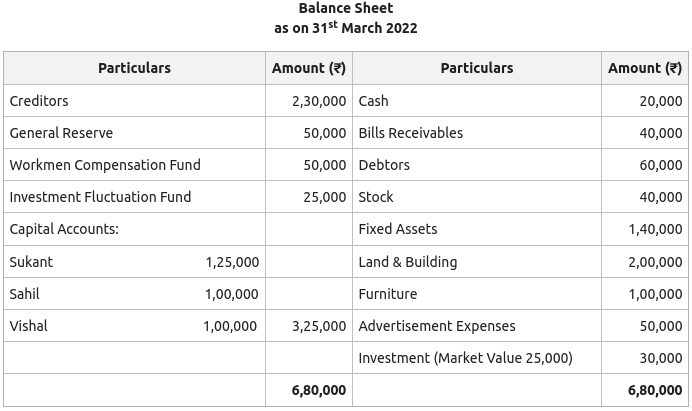

Sukant, Sahil, and Vishal were partners sharing profits and losses in the ratio 2:2:1. Their Balance Sheet as on 31st March 2022 is as follows:

From 1st April 2022, they decided to alter the profit sharing ratio to 5:3:2. It is also decided that:

- 20% Depreciation should be charged on Fixed Assets.

- Creditors amounting to ₹50,000 were not to be paid.

- Provision of 5% on Debtors and Bills Receivables be made for doubtful debts.

- Furniture to be valued at ₹2,00,000.

- It is found that an expense of ₹10,000 is still outstanding.

Pass necessary journal entries, adjust the capital accounts of the partners according to the new profit-sharing ratio, and prepare Revaluation A/c, Partner’s Capital A/c, and the New Balance Sheet of the firm. (Show necessary working notes)

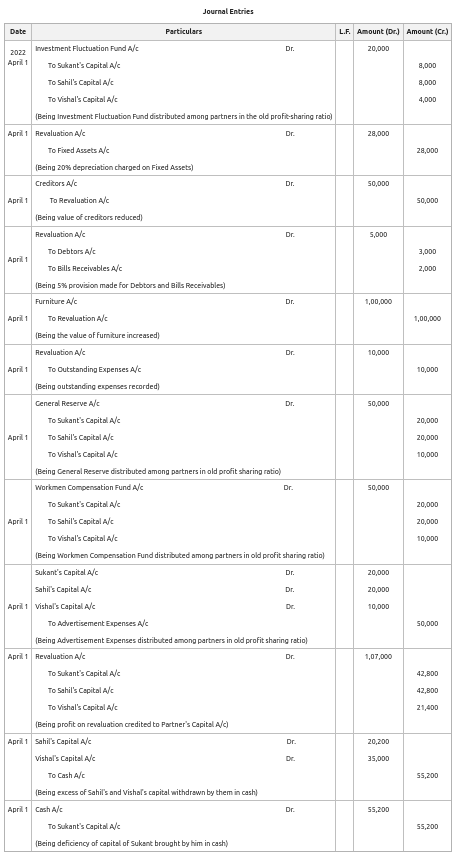

Solution:

Total Adjusted Capital = ₹1,95,800 + ₹1,70,800 + ₹1,35,400

= ₹5,02,000

Sukant’s Capital = ![]()

Sahil’s Capital = ![]()

Vishal’s Capital = ![]()